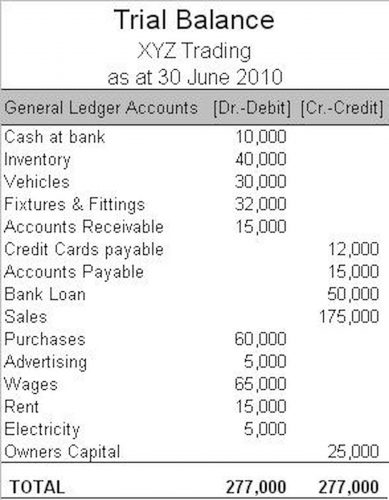

As evident from the table below, each contra account has a parent account whose normal balance is often exactly opposite of the normal balance of the relevant contra account. For example, when depreciating an asset, the accumulated depreciation account is used to reduce the book value of the asset while also keeping track of the total amount of contra expense account depreciation that has been posted to date. We will define what contra accounts are, the types of contra accounts and provide examples to illustrate. An expense account which is expected to have a credit balance instead of the typical debitbalance. A delivery van is purchased by a business to use in delivering product and picking up materials.

Allowance for doubtful accounts

The contra asset account Accumulated Depreciation is deducted from the related Capital Assets to present the net balance on the parent account in a company’s balance sheet. Accounts receivable is rarely reported on the balance sheet at its net amount. Instead, it is reported at its full amount with an allowance for bad debts listed below it.

AccountingTools

- When a company repurchases shares, it increases the fractional ownership of all remaining shareholders.

- The difference between an asset’s balance and the contra account asset balance is the book value.

- Companies like to depreciate assets as quickly as possible to get the tax savings, so the balance sheet may not state the true value of fixed assets.

- For example, a company pays for medical insurance on behalf of its employees, which it records in an employee benefits expense account.

- In a report, layering on that additional context can be easy, but in a general ledger, you have few options for conveying nuance and subtlety.

Then in account 4211 they can see the portion of the cost that was paid by the employees. The company’s income statement will report the combination of the amounts in accounts 4210 and 4211 in order to show the company’s actual expense of $8,000 ($10,000 minus $2,000). If you’re still using manual accounting systems, you’ll need to do a bit more work by recording your accumulated depreciation expense in your general ledger while also reporting it on your balance sheet as a contra asset account. As mentioned, there can be a contra account for any type of transaction depending on a company’s needs. Other than the above contra-asset accounts, we often see contra-revenue accounts for any sales returns or sales rebates.

Popular Types of Contra Accounts

- The account is typically used when a company initially pays for an expense item, and is then reimbursed by a third party for some or all of this initial outlay.

- Therefore, a contra expense account that contains a debit balance must have a negative ending balance.

- Generally in the financial statements the revenue account would be offset against the contra revenue account to show the net balance.

- A separate account is needed whenever the nature of transactions changes.

- Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs.

At the same time, our Accounts Receivable Automation software and Accounts Payable Automation software makes tracking, managing, and processing crucial assets and liabilities — and their contras — easier than ever before. In its general ledger, the business will want to capture its gross sales figures and the actual value of the discount. Note that accountants use contra accounts rather than reduce the value of the original account directly to keep financial accounting records clean. The purpose of a contra expense account is to record a reduction in an expense without changing the balance in the main account. Of that amount, it is estimated that 1% of that amount will become bad debt at some point in the future.

The Allowance for Doubtful Accounts is used to track the estimated bad debts a company my incur without impacting the balance in its related account, Accounts Receivable. An estimate of bad debts is made to ensure the balance in the Accounts Receivable account represents the real value of the account. Allowance for Doubtful Accounts pairs with the Bad Debts Expense account when doing adjusting journal entries.